It starts with a glance at your bank account. Then, a deep breath. Maybe even a little prayer. You open the app… and suddenly, your stomach drops.

Maybe your rent just hit. Maybe your credit card balance is higher than expected. Maybe it’s just the sheer panic of existing in an economy where eggs seem to cost as much as a down payment on a car.

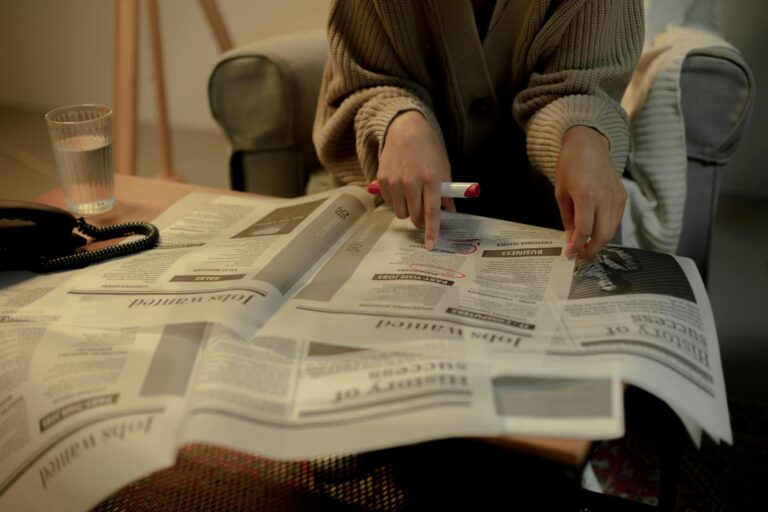

Welcome to financial anxiety, the unwelcome guest living rent-free in our brains. If it feels like everyone you know is stressed about money lately, it’s because, well… they are.

Everyone is Stressed About Money?

Short answer: yes.

Longer answer: Even people who technically should be fine financially still feel the stress. Inflation, rising rent, student loans, unexpected bills—it’s a never-ending carousel of expenses. The cost of living has skyrocketed, but paychecks? Not so much.

A recent study found that over 70% of adults in the U.S. feel stressed about money at least some of the time. And it’s not just people living paycheck to paycheck. Even those making six figures aren’t immune. Why? Because financial stability feels more fragile than ever. One emergency, one bad month, and suddenly, you’re spiraling.

Read More: I Tracked Every Penny I Spent for 3 Months—Here’s What Shocked Me

Why Are We All So Anxious?

A few reasons:

- Everything is more expensive. Rent, groceries, gas—prices have been creeping up, but salaries aren’t rising at the same rate.

- Debt is a constant shadow. Student loans, credit cards, medical bills—it’s hard to feel financially secure when you owe thousands.

- No one taught us how to handle money. Most of us were never given real financial education. We were just thrown into adulthood and told to “budget.”

- Social media makes it worse. Seeing influencers on yachts while you’re debating if you can afford an $8 smoothie? Yeah, that’ll mess with your head.

- The economy is unpredictable. One day the stock market is soaring, the next it’s crashing. Job layoffs are trending. Nothing feels certain.

It’s no wonder so many of us have a financial fight-or-flight response.

The Symptoms of Financial Anxiety

How do you know if you’re dealing with financial anxiety? Here are a few telltale signs:

- Avoiding your bank account. If you’d rather stare directly into the sun than check your balance, you might have financial anxiety.

- Panic every time a bill is due. Even if you technically have the money, the thought of paying bills makes your chest tight.

- Obsessing over every purchase. Feeling guilty over a $4 coffee? Overanalyzing every Amazon cart? Welcome to the club.

- Losing sleep over money. If you’ve ever been up at 2 AM wondering if you’ll ever feel financially secure, you’re not alone.

- Feeling hopeless about the future. Whether it’s homeownership, retirement, or just feeling “stable,” financial anxiety makes the future feel impossible.

Sound familiar? You’re not alone.

So… Is Financial Anxiety the New Normal?

It sure feels like it. But that doesn’t mean it’s inevitable or that you have to accept it as part of your personality. The goal isn’t to magically make all financial stress disappear (because, well, life). It’s about learning how to manage the anxiety instead of letting it run your life.

Read More: I Took a Pay Cut for Work-Life Balance — Was It Worth It?

How to Deal With Financial Anxiety (Without Winning the Lottery)

- Actually Look at Your Finances. Avoidance makes anxiety worse. Schedule a “money check-in” once a week, grab a coffee, and just look at your numbers. Awareness is power.

- Make a Game Plan. Even small steps—like automating savings or setting up a budget—can help you feel more in control.

- Remind Yourself: No One Has It All Figured Out. The people posting about their new cars and designer bags? They might be drowning in debt. Comparison is a trap.

- Celebrate Small Wins. Paid off a credit card? Saved an extra $50 this month? Every step forward counts.

- Talk About It. Financial stress thrives in secrecy. Find people who get it—friends, financial communities, or even a money coach.

- Practice Financial Self-Care. Yes, saving is important, but so is living. Budget in fun money, guilt-free.

- Focus on What You Can Control. You can’t change the economy, but you can build habits that make you feel more financially stable.

Financial anxiety might feel like the new normal, but that doesn’t mean we have to accept it forever. Money stress is real, and the world we live in isn’t exactly making it easy. But small steps, a solid plan, and a little self-compassion can go a long way.

So, if your heart races every time you open your banking app, just know—you’re not alone. And more importantly? You’ve got this.