Not everyone is willing to take significant financial risks. While some investors chase high returns, others prefer stability and predictable growth. If you’re the type who values security over speculation, you need to know which investments will keep your money safe—and which ones could still put you at risk.

Let’s break down the 10 best and 10 worst investments for risk-averse investors, so you can grow your wealth with peace of mind.

If your goal is to protect your money while earning steady returns, these are the best places to invest.

1. High-Yield Savings Accounts

A high-yield savings account is one of the safest places to store your money. Your funds are insured by the FDIC (up to $250,000), and you can access them any time.

While the returns won’t make you rich, they offer better interest rates than traditional savings accounts, helping your money keep up with inflation.

2. Certificates of Deposit (CDs)

Treasury bonds are backed by the U.S. government, making them one of the safest investments available worldwide. They offer steady returns and protection against market volatility.

While they don’t offer high returns compared to stocks, they are great for long-term stability, especially for retirees or conservative investors.

3. U.S. Treasury Bonds

Treasury bonds are backed by the U.S. government, making them one of the safest investments in the world. They offer steady returns and protection against market volatility.

While they don’t have high returns compared to stocks, they’re great for long-term stability—especially for retirees or conservative investors.

4. Dividend-Paying Stocks

Not all stocks are risky. Dividend stocks—shares of companies that regularly pay out a portion of their profits—offer a combination of steady income and potential growth.

Look for well-established companies with a history of consistent dividend payments, such as Procter & Gamble, Coca-Cola, or Johnson & Johnson.

5. Index Funds (S&P 500, Total Market Funds)

Instead of trying to pick individual stocks, index funds let you invest in the entire market. These funds track major stock indexes, such as the S&P 500, offering steady growth with reduced risk.

Historically, the S&P 500 has averaged about 10% annual returns. It’s not risk-free, but it’s one of the safest ways to invest in stocks without constant worry.

6. Municipal Bonds

Issued by local governments, municipal bonds are a safe and tax-advantaged way to earn a fixed income. They are considered low-risk because they are backed by state or city governments.

They offer lower returns than corporate bonds, but are a great choice for conservative investors seeking tax-free earnings.

7. Real Estate Investment Trusts (REITs)

REITs let you invest in real estate without owning physical property. These companies generate income by renting or leasing properties and then passing the profits on to investors as dividends.

Look for well-established REITs with a proven track record of steady dividend payments. They provide passive income and are less volatile than individual stocks.

8. Money Market Accounts

Money market accounts function like a hybrid between a savings account and a checking account. They offer slightly higher interest rates than regular savings accounts while allowing limited withdrawals.

These are great for storing emergency funds or short-term savings while earning small but stable returns.

9. Bond ETFs

Bond ETFs combine various bonds into a single, diversified investment. They offer steady returns and lower risk compared to individual stocks.

For risk-averse investors, government and corporate bond ETFs are a solid way to earn passive income while avoiding stock market volatility.

10. Target-Date Funds

If you’re investing for retirement and don’t want to manage your portfolio actively, target-date funds automatically adjust their investments over time.

They start with a mix of stocks and bonds and gradually shift to safer assets as you get closer to retirement. It’s a hands-off way to invest wisely with minimal risk.

The 10 Worst Investments for Risk-Averse Investors

These investments carry high risk, exhibit significant price fluctuations, or yield unpredictable returns. If you hate risk, steer clear.

1. Penny Stocks

Penny stocks are cheap for a reason—most are from unproven or struggling companies. They are highly volatile and prone to scams, making them a poor choice for conservative investors.

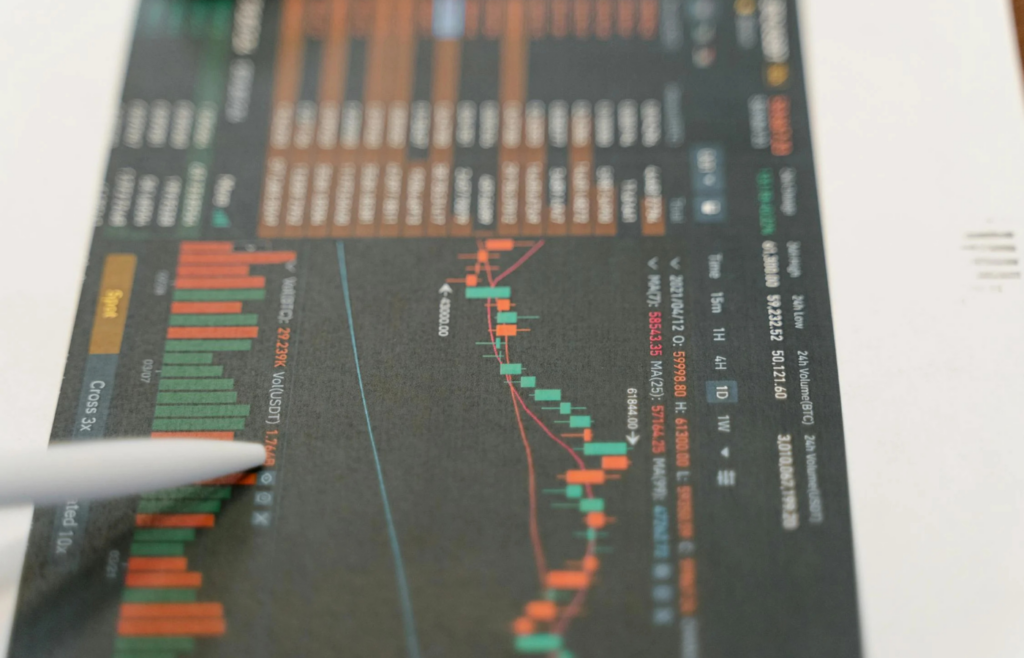

2. Cryptocurrency

Crypto has made some people rich, but its extreme volatility makes it one of the riskiest investments. Prices can fluctuate significantly based on speculation, regulatory changes, or social media hype.

If you’re risk-averse, keep crypto to a small percentage of your portfolio—or avoid it altogether.

3. Options Trading

Options trading is a complex process that can lead to substantial losses. Unlike regular stocks, options expire, meaning you could lose your entire investment if your bet is wrong.

Unless you fully understand how options work, this is one of the riskiest investment strategies out there.

4. Individual Stocks in Small Startups

Investing in early-stage companies can yield substantial rewards, but also incur significant losses. Most startups fail, and their stock prices can be volatile.

Instead of betting on a single company, consider diversifying with index funds or ETFs for added stability.

5. High-Yield Corporate Bonds (“Junk Bonds”)

Junk bonds promise high returns, but they’re called “junk” for a reason. They are issued by companies with poor credit ratings, which means a higher risk of default.

Safer alternatives? Stick with investment-grade bonds or Treasury bonds.

6. Leveraged ETFs

Leveraged ETFs use borrowed money to amplify returns, but this also means amplified losses. They’re extremely risky and not suitable for long-term, risk-averse investors.

7. Flipping Houses Without Experience

TV shows make house flipping look easy, but it’s actually a risky and unpredictable process. Unexpected repair costs, market downturns, or difficulty selling can turn a profitable deal into a financial disaster.

8. Foreign Currencies (Forex Trading)

Forex trading is a fast-paced, speculative activity that requires a deep understanding of global markets. Even professional traders lose money. If you’re looking for stability, this isn’t the place to invest.

9. NFTs (Non-Fungible Tokens)

NFTs were a hot trend, but their value is unpredictable. Many early investors made a profit, but prices have since crashed, leaving many with worthless digital assets.

10. Collectibles (Rare Art, Cars, Memorabilia)

Collectibles can be fun, but they’re not reliable investments. Their value depends on demand, and they do not provide a steady income. If you need financial security, skip speculative assets.

Final Thoughts

If you prefer low risk, consider safe, steady investments such as bonds, index funds, and dividend stocks. Avoid speculation, high-volatility assets, and anything that feels like a gamble. Investing wisely doesn’t mean avoiding risk altogether—it means managing it smartly for long-term success.