Your 20s feel like endless time to get everything figured out, but the financial decisions you make during this decade can end up costing you hundreds of thousands of dollars over the course of your life. These aren’t little mistakes; they’re career and money mistakes that compound into enormous wealth gaps by the time you’re in your forties.

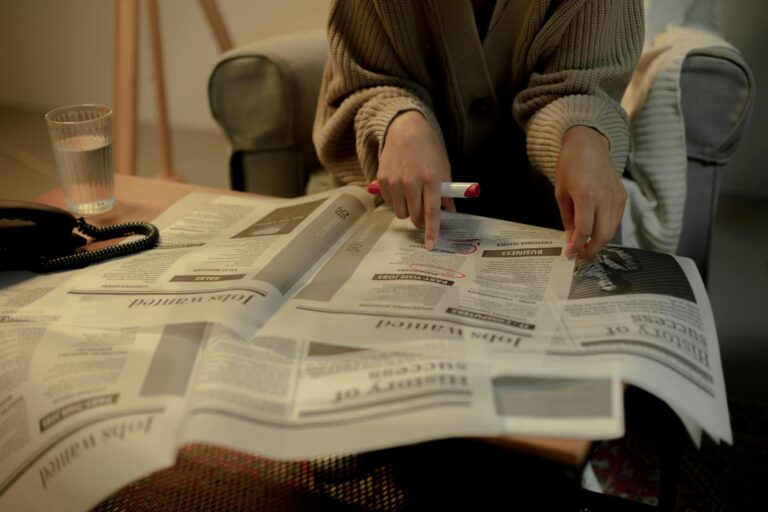

Job-Hopping Without Strategy

Job-hopping every six months might seem like career dynamism, but it’s normally financial suicide. Instability patterns are observed by Employers, which in turn questions your commitment. And you can also miss out on benefits such as 401(k) investing, stock options, and performance bonuses. Strategic job changes every 2-3 years are acceptable. Random job-hopping will lose you six figures in lost benefits and career advancement.

Accepting First Salary Offers

By failing to negotiate, you’re giving up money that accrues over the period of your entire career. Accepting an offer of $50,000 instead of negotiating to $55,000 means that $5,000 difference is $200,000+ in your lifetime when you factor in raises, promotions, and compound growth. Most employers expect negotiation; they worry when candidates fail to advocate for themselves.

Not Paying Attention to Retirement Accounts at All

“I’ll start saving in my thirties” is one of the most expensive statements in personal finance. A $200 monthly 401(k) contribution from age 22 totals over $1 million at retirement. Wait until 32 to start, and you’ll have less than half that. The math is unforgiving, and the opportunity cost of waiting is even more catastrophic.

Lifestyle Inflation After Every Raise

You get a raise, and you immediately upgrade your apartment, car, and clothes. This cycle has you living paycheck to paycheck, even with income. Instead of inflating your lifestyle with every raise, try the 50-30-20 rule: only spend 50% of your raise, save 30%, and invest 20% for long-term goals.

Not Having an Emergency Fund

Without an emergency fund, every unexpected expense becomes debt. Car repair goes on a credit card. The medical bill goes on a credit card. Job loss causes a financial crisis. Having even a $1,000 emergency fund in place prevents these situations from becoming expensive debt cycles that take years to recover from.

Read More: 15 Things Ambitious People Do on the Weekend That Others Don’t

Picking Jobs Based on Pay Alone

To take the highest paying job, no matter what career growth opportunities, company environment, or education opportunities, usually results in disillusionment. A lower-paying job at a successful company with room to learn often results in greater life incomes than a high-paid, no-growth job.

Read More: 15 Signs Your Job Is Slowly Killing Your Ambition

Neglecting Career Development

Not going to conferences, not certifying, or upgrading skills because they cost money is short-sighted. Your earning power depends on keeping current in your profession. That $2,000 class you don’t go to today could cost you $20,000 in lost opportunity tomorrow.

Making Minimum Credit Card Payments

Payoff for minimum payments on credit card balances can be 30+ years. A $5,000 balance with an 18% interest rate takes over $13,000 in total payments when only making minimum payments. Attack debt aggressively in your twenties, and your future self will thank you.

Not Knowing Employee Benefits

Most people choose careers without fully understanding health insurance, 401(k) matching, or other benefits. These “hidden” compensation pieces can be worth $10,000-20,000 annually. Always calculate total compensation, not salary alone.

Geographic Financial Decisions

Moving to expensive cities without researching the cost of living versus salary increases can destroy your financial progress. That $10,000 raise can disappear when rent is $15,000 more annually.

Your 20s set the financial stage for everything that follows. These mistakes aren’t just expensive, they’re opportunity killers that compound over the course of a lifetime. Learning about these trends now means you can course-correct while they are still not lifelong wealth hurdles.

Read More: 15 Career Trends That Seemed Stupid at First But Are Booming Now