Achieving millionaire status often involves making bold financial decisions that deviate from conventional wisdom. Here are ten daring money moves that transformed ordinary individuals into millionaires:

1. Investing in Undervalued Stocks During Economic Downturns

Sir John Templeton made a fortune by purchasing shares of companies trading below $1 during the Great Depression, demonstrating the potential of investing when others are fearful.

2. Leveraging Real Estate at a Young Age

Ruth and Becky Shipley began their property investment journey at age 20, eventually building a portfolio worth over £2 million and achieving financial freedom.

3. Dropping Out of College to Pursue Entrepreneurship

Patrick Collison left MIT to co-found Stripe, a fintech company now valued at billions, illustrating the rewards of pursuing entrepreneurial ventures over traditional education paths.

4. Transforming a Modest Gift into a Trading Fortune

Timothy Sykes turned a $12,415 Bar Mitzvah gift into over $1 million through penny stock trading, highlighting the potential of strategic investing.

5. Capitalizing on Emerging Markets

Sir John Templeton pioneered globally diversified mutual funds, investing early in markets like Japan, which contributed significantly to his wealth.

6. Building a Business in a Niche Industry

Shawn Meaike transitioned from social work to founding successful businesses in life insurance and waste management, leading to substantial wealth.

7. Participating in Experimental Investment Programs

Richard Dennis trained novices, known as the “Turtles,” in commodities trading, many of whom became millionaires by following his trend-following strategies.

8. Pursuing Passion Projects with Business Potential

David Geffen’s passion for music led him to establish record labels and amass significant wealth by signing major artists.

Read More: 10 Tiny Money Mistakes That Can Ruin Your Retirement Dreams

9. Embracing High-Risk, High-Reward Investment Vehicles

Chamath Palihapitiya utilized special-purpose acquisition companies (SPACs) to democratize investments in high-growth startups, accruing substantial wealth.

Read More: 10 Signs It’s Time to Change Your Career

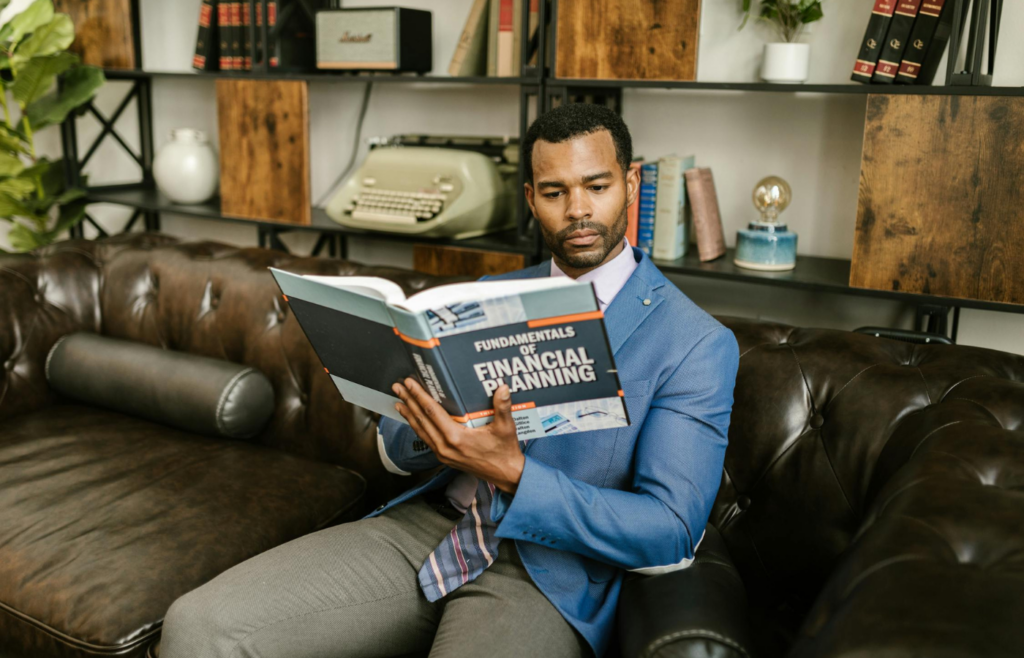

10. Prioritizing Financial Education and Strategic Planning

Grant Sabatier educated himself on personal finance, leading to financial independence and millionaire status by age 30.

These examples underscore the importance of bold, informed decisions and the willingness to take calculated risks in the journey toward financial success.

Read More: 10 Retirement Myths That Are Keeping You Broke