Planning for retirement is a crucial endeavor that requires foresight and meticulous attention to detail. However, certain oversights can significantly impact your financial security in your later years.

Recognizing these mistakes can change the way you live your retirement. Here are 15 retirement planning mistakes you might not realize until it’s too late:

1. Delaying Retirement Savings

Postponing retirement savings can severely limit the benefits of compound interest, making it challenging to accumulate sufficient funds for a comfortable retirement.

2. Underestimating Healthcare Expenses

Many retirees overlook the substantial costs of healthcare, including services not covered by Medicare, which can lead to financial strain.

3. Claiming Social Security Benefits Too Early

While eligible at 62, claiming Social Security benefits early results in reduced monthly payments, potentially affecting long-term financial stability.

4. Overlooking Inflation’s Impact

Failing to account for inflation can erode your savings’ value, diminishing your purchasing power over time.

5. Neglecting Long-Term Care Planning

Without provisions for long-term care, unexpected expenses can rapidly deplete retirement funds.

6. Relying Solely on Employer Pensions

Depending entirely on employer pensions without personal savings can be risky, especially if the pension plan faces financial difficulties.

7. Ignoring Tax Implications

Not understanding how different retirement accounts are taxed can lead to unexpected liabilities, reducing your net income.

8. Maintaining an Overly Conservative Investment Portfolio

While caution is prudent, excessively conservative investments may not yield returns that outpace inflation, hindering portfolio growth.

9. Failing to Diversify Investments

Concentrating investments in one asset class increases risk; diversification helps mitigate potential losses.

10. Overlooking Estate Planning

Without proper estate planning, your assets may not be distributed as intended, leading to potential legal complications and unintended beneficiaries.

11. Misjudging Retirement Lifestyle Expenses

Underestimating the cost of desired retirement activities can lead to financial shortfalls, affecting your quality of life.

12. Not Adjusting Spending Habits Post-Retirement

Failing to modify spending in line with a fixed retirement income can rapidly deplete savings.

13. Supporting Adult Children Financially

Continuing to provide financial support to adult children can strain retirement resources, jeopardizing your financial security.

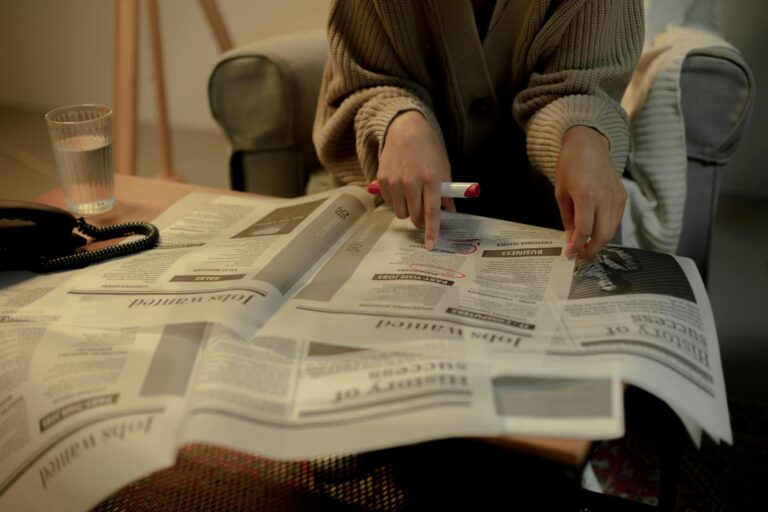

Read More: The 10 Most Underrated Ways to Save Money That No One Talks About

14. Neglecting Regular Portfolio Reviews

Without periodic reviews, your investment strategy may become misaligned with your retirement goals and risk tolerance.

Read More: 10 Signs You’re Better With Money Than You Think

15. Assuming You’ll Work Indefinitely

Planning to work indefinitely is uncertain; unforeseen circumstances like health issues can force early retirement, underscoring the need for adequate savings.

Avoiding these pitfalls through proactive planning and regular financial assessments can help ensure a secure and fulfilling retirement.

Read More: 10 Money Moves You’ll Probably Regret in 10 Years