Many individuals believe they’re on track for a comfortable retirement, only to discover later that they’re not as prepared as they thought. This false sense of security can lead to financial stress in the later years of life.

Recognizing the signs early can help you adjust your plans and secure your financial future. Here are 15 indicators that you might be behind on your retirement preparations:

1. Lack of a Clear Financial Plan

Without a detailed financial plan outlining your retirement goals, income sources, and projected expenses, it’s challenging to gauge your readiness for retirement.

2. Insufficient Retirement Savings

If your retirement savings are significantly below recommended benchmarks for your age, it may indicate you’re not on track. For instance, by age 50, aiming for six times your annual salary in savings is advisable.

3. Relying Solely on Social Security

Depending entirely on Social Security benefits can be risky, as they often aren’t sufficient to maintain your pre-retirement lifestyle.

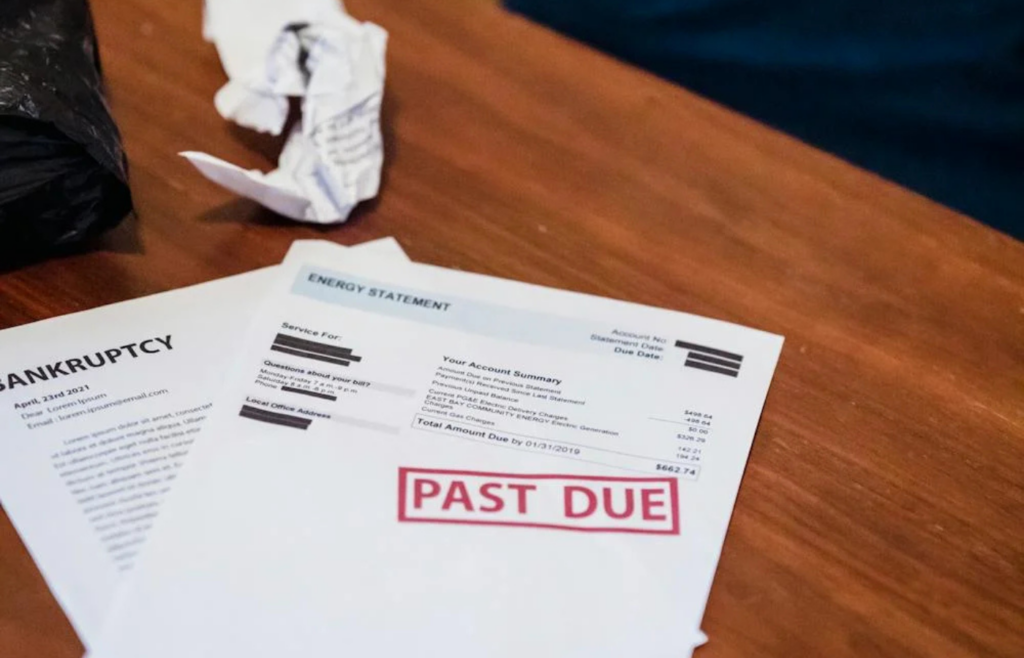

4. High Levels of Debt

Entering retirement with substantial debt, such as credit card balances or unpaid loans, can strain your fixed income and deplete savings faster than anticipated.

5. No Emergency Fund

Lacking an emergency fund means you might have to dip into retirement savings for unexpected expenses, jeopardizing your financial stability.

6. Unawareness of Retirement Expenses

Underestimating or not knowing your expected expenses in retirement can lead to insufficient savings and financial shortfalls.

7. No Healthcare Cost Planning

Failing to account for healthcare expenses, which often increase with age, can rapidly deplete your retirement funds.

8. Inconsistent Retirement Contributions

Irregular or paused contributions to retirement accounts can significantly reduce the compounding growth of your savings.

9. Lack of Investment Strategy

Not having a clear investment strategy or being overly conservative can hinder the growth potential of your retirement portfolio.

10. Still Supporting Adult Children

Continuing to financially support adult children can divert essential funds away from your retirement savings.

11. No Estate Planning

Without proper estate planning, your assets may not be distributed as intended, potentially causing financial complications for your heirs.

12. Unrealistic Retirement Age Expectations

Planning to retire earlier than financially feasible can lead to inadequate savings and increased financial stress.

13. Not Maximizing Employer Benefits

Failing to take full advantage of employer-sponsored retirement plans or matching contributions means missing out on free money and growth opportunities.

Read More: 10 Side Hustles That Can Turn Into Full-Time Careers

14. Ignoring Inflation Impact

Not accounting for inflation can erode the purchasing power of your savings, making it challenging to maintain your standard of living.

Read More: Top 10 High-Paying Jobs You Can Get Without a Degree

15. No Plan for Long-Term Care

Overlooking the potential need for long-term care can result in substantial, unplanned expenses that may deplete your retirement assets.

Recognizing these signs early allows you to make necessary adjustments, seek professional advice, and implement strategies to enhance your retirement readiness.

Read More: 10 Jobs That Will Likely Be Obsolete in the Next 20 Years